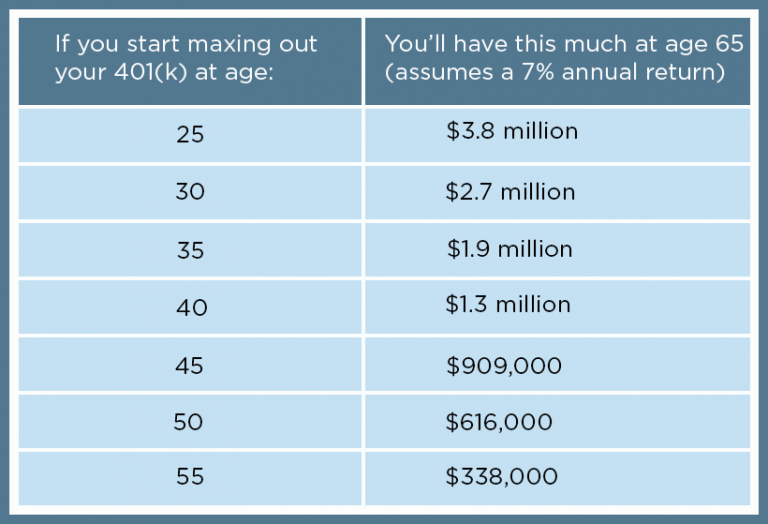

Use the annual compensation limit in effect at the beginning of the plan year.If youre age 50 and older, you can add an extra 1,000 per year in 'catch-up' contributions. Use the taxable wage base (TWB) in effect at the beginning of the plan year. The maximum amount you can contribute to a Roth IRA for 2021 is 6,000 if youre younger than age 50.Deferral limits are on a calendar year basis, regardless of plan year.For plans that include salary deferral features, individuals who are age 50 and older by the end of the calendar year may make catch-up contributions in addition to the annual addition limit, if catch-up contributions are permitted under the plan.The term “annual additions” generally means the sum for any year of employer contributions, employee contributions, and forfeitures.Qualified Longevity Annuity Contract (QLAC)ĮSOP amount to determine lengthening of the 5-year Distribution RuleĮSOP Maximum Balance subject to the 5-year Distribution Ruleĭefinition of Highly Compensated Employee*ĭefined Benefit Plan Single Employer Flat PBGC Rate Premiumĭefined Benefit Plan Single Employer Variable Rate Premiums/$1,000 UVB RETIREMENT PLAN LIMITS HEALTH AND WELFARE PLAN LIMITS Health Savings Account and High Deductible Health Plan Limits Earlier this year, the IRS announced the inflation-adjusted amounts for health. 2023 Annual Plan Limitsĭefined Benefit/Cash Balance Plan - Annuity LimitĤ01(k), 403(b) and 457 Plan Elective Deferrals You contribute 20,500the maximum amount you’re allowed to put into your 401(k) in 2022. Advisors: A downloadable version of our Annual Plan Limits is available here.

0 kommentar(er)

0 kommentar(er)